Abe Supporter Iwaya Sees Integrated Resorts Providing Significant Boost to Japan GDP

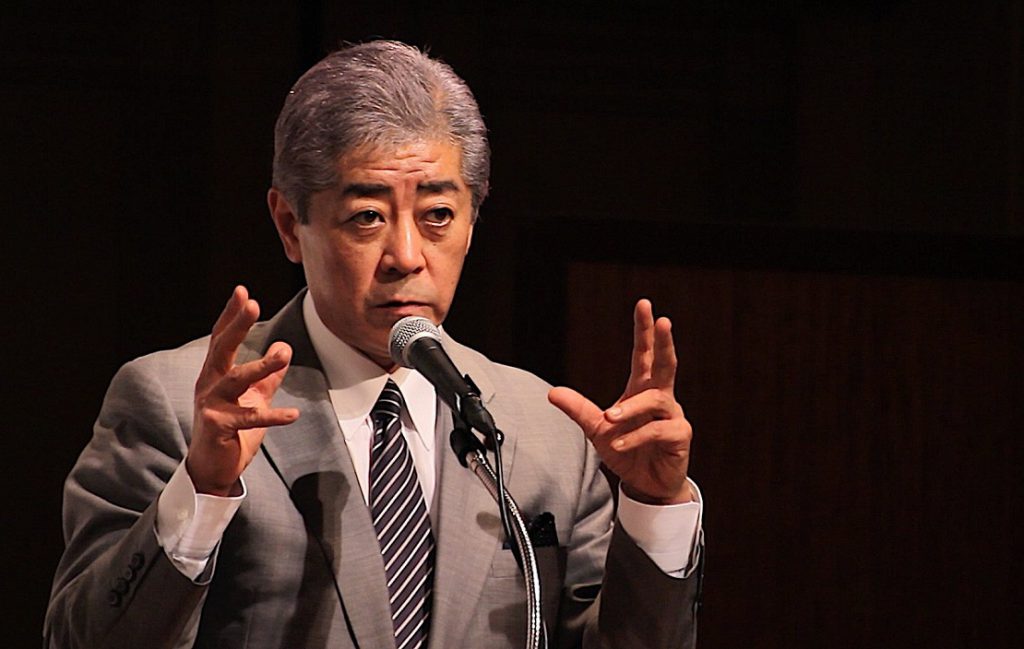

Takeshi Iwaya, a member of Prime Minister Shinzo Abe’s Liberal Democratic Party, believes integrated resorts can be a boon for Japan’s economic growth.

Iwaya, who recently served as Japan’s minister of defense and now leads a multi-party committee in the country’s House of Representatives, believes casino gaming can bolster gross domestic product (GDP) growth in the world’s third-largest economy by as much as one percent..

It’s still too early to say what economic benefits integrated resorts will generate. But I am personally hopeful they will eventually push up Japan’s GDP by 1 percent or more,” said the politician in a recent op-ed published in The Japan Times, an English language Japanese newspaper.

A long-held belief among Japanese politicians and regulators that favor bringing integrated resorts to the Land of the Rising Sun is that if the venues are high quality, the properties will bring more tourists to the country, creating more jobs and generating tax revenue beyond the direct employment and receipts associated with the gaming venues themselves.

Some operators that are vying to land one of the first three gaming licenses in Japan are in tune with the tourist objective. For example, Melco Resorts, which is hoping to build a casino in Yokohama, recently said it plans to construct two non-gaming properties in Japan, including a ski resort near Nagano.

More Than Conventions

Meetings, incentives, conferences and exhibitions (MICE) are big business in the gaming industry and serve as one the largest revenue drivers for operators in Las Vegas. But Iwaya believes Japan’s integrated resorts can do more than lure business travelers.

The venues can increase GDP “not just by hosting a slew of international conferences, but by increasing the number of tourists from abroad,” said the politician.

Japan has a long-stated goal of boosting tourism to 40 million foreign visitors by the end of next year and 60 million by 2030. The latter figure, if attained, would be nearly double the 31.2 million international visitors to the country last year.

The desire to drive higher visitation rates among foreigners is viewed as one reason why gaming industry behemoths with reputations for developing high-end properties, particularly in Asia, including Las Vegas Sands, Melco, and Wynn Resorts, are seen as some of the leaders in the Japan gaming license competition.

Clear Tourism Push

Although regulators have yet to award any gaming permits and it’s expected that ground will not be broken on the projects until 2021 at the earliest, Japanese law makes clear that the country’s gaming industry will be about much more than casinos.

“The casino law stipulates that envisioned integrated resorts be equipped with not just casinos, but other facilities, including hotels, recreational areas, and convention halls,” said Iwaya. “This is critical for Japan, as the nation is fast lagging behind its rivals overseas in luring international conferences and exhibitions, partly due to a lack of spacious venues that can host large-scale events.”

While some operators have pitched lower estimates, analysts believe the costs to build high end integrated resorts in Japan that would be of comparable or superior quality to the gaming properties in Macau and Singapore would range from $10 billion to $15 billion per venue.

No tags for this post.